Family Wealth Protection

Estate, Tax and Real Estate Planning Law Firm in North York | Toronto

AGI Law Works With Professionals To Build And Protect Your Wealth

Support for Every Stage Of Wealth

Foundation

Focus on wealth development

Create solid foundation

Set financial targets

Expansion

Focus on wealth growth

Create diversified portfolio

Develop long strategy

Preservation

Focus on wealth preservation

Create retirement plan

Explore legacy planning

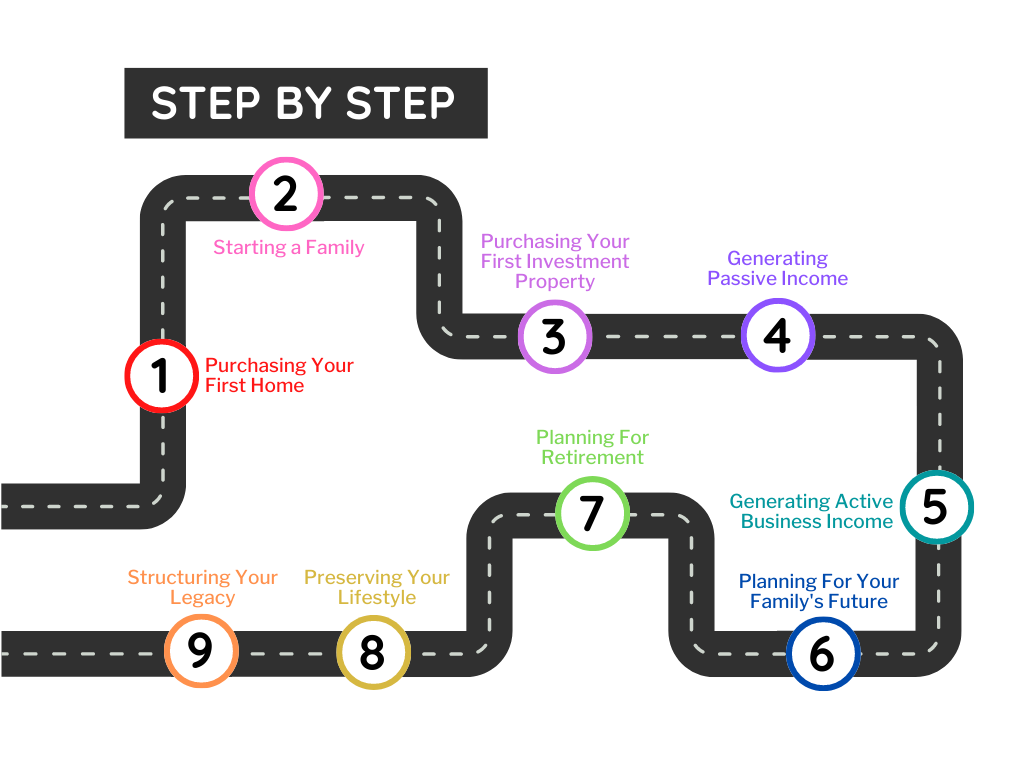

Path of Canadian Wealth

Step 1: Bank Financing, Real Estate Closings

Step 2: Wills & Powers of Attorney, Trusts for Your Children

Step 3: Private Financing, Tax Planning, Real Estate Closings

Step 4: Private Equity Investments, Tax Planning

Step 5: Establishing & Buying a Business, Shareholder Law

Step 6: Advanced Estate Planning, Family Law Planning

Step 7: Corporate Succession Planning, Employment Sunsets

Step 8: Budget Management, Structured Investing

Step 9: Gifts, Not-for-Profit Philanthropy, Legacy Package

Our Google Reviews